Pag Ibig Financing Meaning

That means you can expect a repricing 5 times during the entire term. This is because that as a secured form of financing Pag-IBIG Fund will require a collateral which in this case is your future homes clean Title TCTCCT issued by the Registry of Deeds.

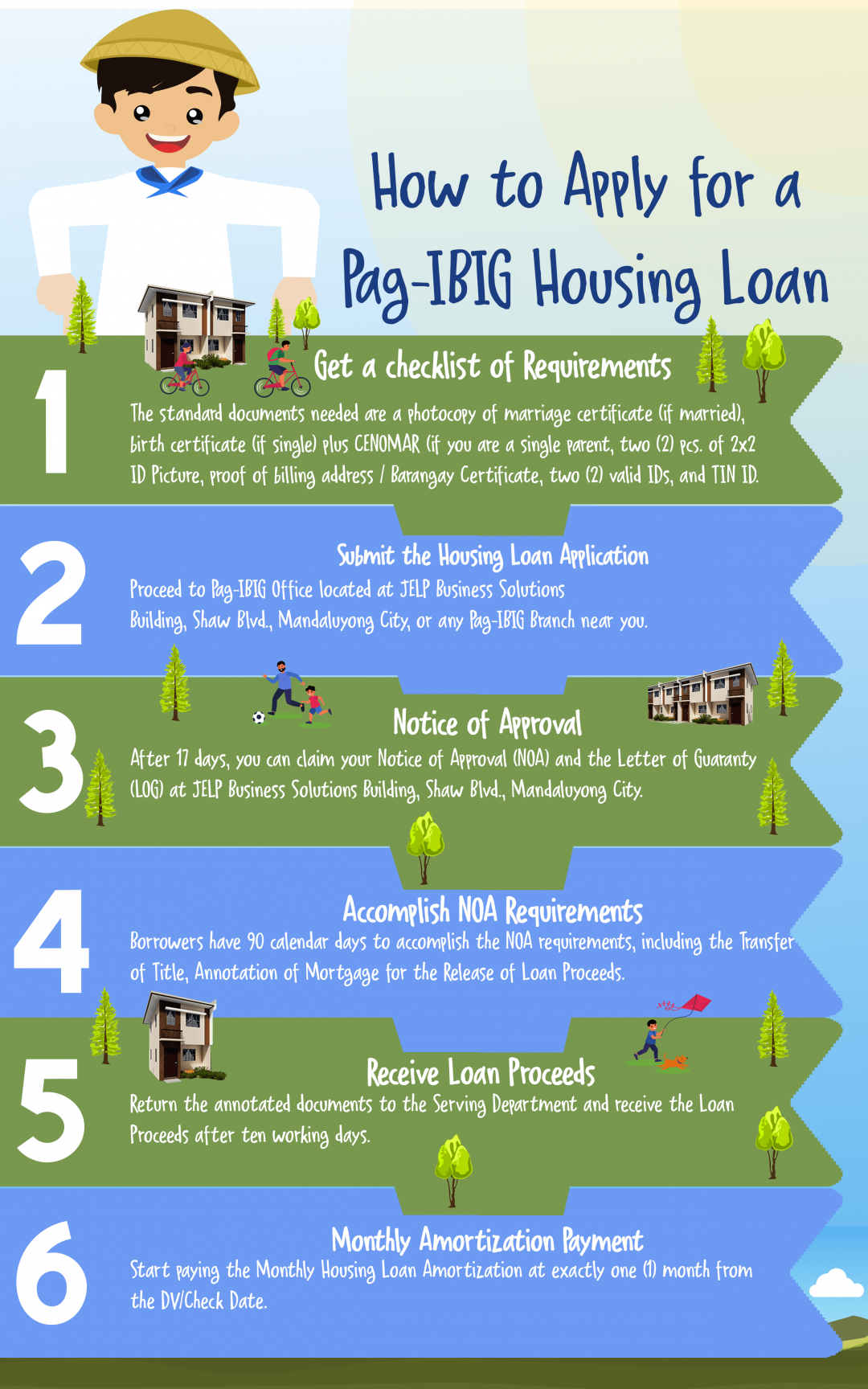

How To Apply For A Pag Ibig Housing Loan Lumina Homes Pag Ibig Housing Loan

As mandated by RA.

Pag ibig financing meaning. PAG-IBIG Fund is a government-run mutual fund developed for the primary purpose of providing affordable housing programs for the majority of Pinoys. Can I get Pag-IBIG financing for Pag-IBIG foreclosed propertiesacquired assets. Aside from housing another goal of the PAG-IBIG Fund is to generate savings.

You promise to repay loan on time as set in the agreement. For security reasons you will be asked to create your Virtual Pag-IBIG Account. The obvious answer is Yes you can purchase the foreclosed properties through a Pag-IBIG loan.

The government-mandated Home Development Mutual Fund more popularly known as the Pag-IBIG Fund gives its contributing members the power to finance their home purchase at a more affordable rate as compared to the rates offered by real estate developers and banks. Enjoy Pag-IBIG Fund services anytime anywhere with the Virtual Pag-IBIG. Pag-IBIG Savings I also called Provident Savings is a regular savings program for all members of the Pag-IBIG Fund or Home Development Mutual Fund HDMF.

For example you can choose a 3-year repricing for a 15-year term. The Fund was established on 11 June 1978 by virtue of. Notarized LMA with the original RD stamp.

49 línur Pag-IBIG Loyalty Card Plus Application Form. Eventually we hope that you will enjoy being a member of Pag-IBIG Fund whether you are based locally in the Philippines or a Filipino Expat working abroad. For employees this involves a salary deduction for Pag-IBIG contribution with their employers share of contribution.

This is an electronic service designed for employers for the EASIER SUBMISSION of their monthly remittance file to Pag-IBIG. Thirty-six years after it was established in 1978 the Pag-IBIG Fund now boasts 138 million members and 66 local and 19 international branches. Real estate properties are seldom bought on one-time spot cash basis.

Moreover if you do fail to pay your amortization payments on time there is a huge risk of getting your property foreclosed or taken away by Pag-IBIG to recuperate the loss from failed payments. By Pag-IBIG Financing Admin. Officially the Home Development Mutual Fund HDMF this provident funding program is more commonly known by its amorous acronym the Pag-IBIG Fund.

This means that when you sign a housing loan with Pag-IBIG there are two points that you need to keep in mind. The birth of the Home Development Mutual Fund HDMF more popularly known as the Pag-IBIG Fund was an answer to the need for a national savings program and an affordable shelter financing for the Filipino worker. You can try our Amortization Calculator below.

The Home Development Mutual Fund HDMF more popularly known as the Pag-IBIG Fund was an answer to the need for a national savings program and an affordable shelter financing for the Filipino worker. Make sure to use the correct interest rate for the. Additional requirements depending on loan purpose.

Pag-Ibig offers very affordable terms that can be stretched up to 30 years. 9510 pr the Credit Information Systems Act CISA the Pag-IBIG Fund is required to submit its housing loan borrowers Basic Credit Data and other credit information to the Credit Information Corporation CIC. You can think of this website as an educational resource for learning more about Pag-IBIG Fund how you can benefit from it and how to properly utilize the Fund on which you are a member and maybe your friends and relatives too.

Occupancy permit if purchasing a new residential unit purchasing a lot for house construction constructing a house and improving an existing residential property. Its your Lingkod Pag-IBIG 247. Its easy its convenient.

Again please refer to the Invitation to Bid to get the complete details or contact Pag-IBIG directly. The Birth of The Home Development Mutual Fund. One of the most important things you need to understand about Pag-IBIG Housing Loan or any mortgage loan for that matter is that it is a secured form of financing.

Many buyers usually finance their homes for a longer payment period say 10 years and even 30 years. History of Pag-IBIG Fund. When purchasing a real property using long term financing such as Pag-IBIG Housing Loan the buyer is usually asked to put a minimum down payment.

For security reasons you will be asked to Log In your Virtual Pag-IBIG Account. The loan term is not dependent on the repricing or fixing period you have chosen.

Pag Ibig Housing Loan 2021 Requirements And Application Process

Komentar

Posting Komentar