Pag Ibig Lump Sum 20 Years

The guidelines below will help you create an e-signature for signing pag ibig lump sum form 2020 in. The member shall be compulsorily retired upon reaching age.

Comprehensive Guide To Pag Ibig Contribution Online Verification And Loans In 2020

The MP2 program allows you to access your funds more quickly with a five-year maturity period than the regular Pag-IBIG savings program and other long-term investment vehicles with maturity periods ranging from 10 to 20 years.

Pag ibig lump sum 20 years. When and how to claim your Pag ibig lump sum. This means you made contributions for at least 20 years or an equivalent of 240 monthly contributions. For Pag-Ibig Overseas Program POP members they should meet the 4 10 15 or 20 years of accumulated contribution depending on their chosen option during membership registration.

For retirement purposes the valid IDs must reflect the members date of birth. Unlike SSS where you are member for life and cannot withdraw your contributions until you turn 60 and opt for pention or lump sum payments a Pag-ibig member can opt to withdraw his contributions under the following conditions. In case you are still under the PAG-IBIG Overseas Program POP which is different from the present PAG-IBIG savings you may withdraw your money on the 10th 15th or 20th year depending on what you chose during your registration.

MS may pay his MS for the lacking months. Pag-IBIG Overseas Program POP MS of Overseas Filipino Workers OFWs who are Pag-IBIG I members shall be considered in counting the total number of MS for availment of housing loans. With the collaboration between signNow and Chrome easily find its extension in the Web Store and use it to e-sign pag ibig lump sum form 2020 right in your browser.

Simply present your POP passbook to make a claim. For Pag-IBIG Overseas Program POP members membership with the Fund shall be at the end of five 5 ten 10 fifteen 15 or twenty 20 years depending on the option of the member upon membership registration. After that period you can withdraw all your savings or let it keep earning dividends for.

Youve paid your Pag-IBIG contributions for at least 20 years equivalent to 240 monthly payments. If the valid IDs do not reflect the date of birth submit any of the following. I see 3 possible options for you.

Retirement As a member reaches the age of 65 he or she is considered retired. If youre a Pag-IBIG Overseas Program POP member you can claim your contributions at the end of five 10 15 or 20 years depending on the option. When the new rates take effect on July 1 Pag-IBIG Funds End-User Financing Program will come with rates of 5500 for a 1-year fixed-pricing period 6500 for 3 years 7270 for 5 years 8035 for 10 years 8585 for 15 years 8800 for 20 years 9050 for 25 years and 10000 under a 30-year fixed-pricing period.

If you like you can also save with Modified Pag-ibig. A member may withdraw his TAV or savings after 20 years of membership with the Fund and after having made a total of 240 monthly contributions. If youre a Pag-IBIG Overseas Program POP member you can claim your contributions at the end of five 10 15 or 20 years depending on the option you chose during your membership registration.

- Birth Certificate of Member issued by Philippine Statistics Authority PSA. Membership Maturity Youve paid your Pag-IBIG contributions for at least 20 years equivalent to 240 monthly payments. The member must have remitted at least 240 monthly membership contributions with the Fund.

Not more than sixty-five 65 years old at the date of loan. In other words just maximize what you have. But dont get me wrong.

So now lets compare the returns on investments of time deposit regular Pag-ibig and MP2 in the last 5. This means the Pag-IBIG Fund will hold your MP2 savings for five years. For OFWs the maturity of their POP memberships would be in 10 15 and 20 years.

For Pag-ibig what you get is not pension but a lump sum of your total savings plus dividends. PAG-IBIG FUND PART 1Pag ibig contribution from 10 years 15 years and 20 yearsMapapakinabangan naThis video. Im not telling you that investing in a lump sum is the only way to go.

Certainly the important thing here is that you are making progress. If Pag-IBIG Loyalty Card is not available two 2 valid IDs present original and submit photocopy. Membership term maturity You can get your Pag-ibig savings after accumulating 20 years of contributions or 240 contributions whether youre working or not or Early Retirement at age 45 if your company has an early retirement program or Retirement age 60 whether working or not.

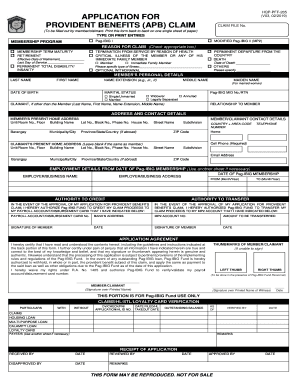

Pag-IBIG members can only file for Provident Benefits Claim once they have completed 240 monthly contributions and are at the retirement age of 60 to 65 years. For both cases the lump sum payment shall be based on MS that correspond to the loan amount applied for.

Pag Ibig Fund Withdrawal Of Contributions Isensey

Komentar

Posting Komentar